At our lending app software development company, we create customized progressive solutions, especially for financial business clients. These kinds of apps are designed to lend processes, improve customer experiences, and enhance operational efficiency.

.png)

Our Lending App Development Solution integrates loan origination systems that provide lenders with real-time access to information about borrowers, credit scores, and loan details. Such integration enhances decision-making, increases loan processing speed, and provides a seamless experience for both lenders and borrowers.

Our digital wallet solutions make secure, fast, and convenient transactions possible. Fund access, advanced encryption, and the option to hold multiple forms of payment will make creating, tracking, and modifying payments easier and safer than ever.

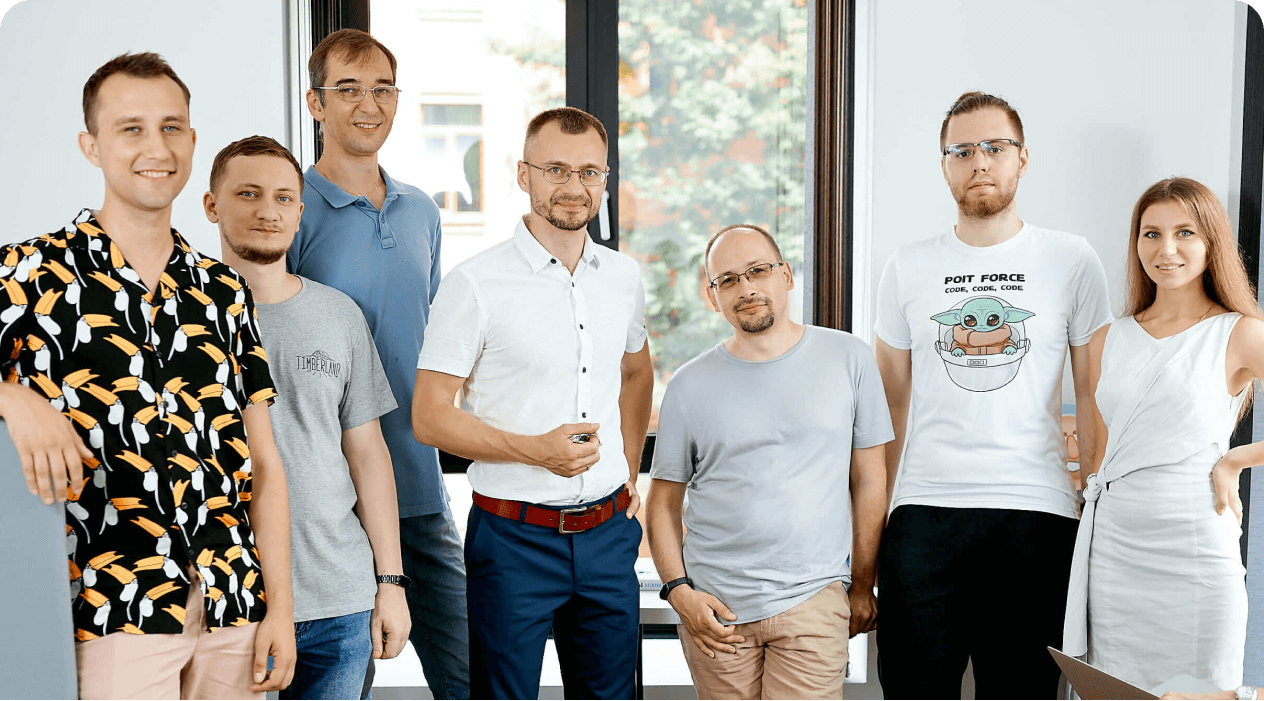

Boolean Inc. combines industry expertise with technological innovation to deliver customized lending app development solutions designed for your success.

The Lending Application Development Process involves creating a digital platform that facilitates loan origination, management, and disbursement. It typically includes stages such as requirement gathering, designing user-friendly interfaces, integrating secure payment gateways, ensuring compliance with financial regulations, and testing for performance and security.

Research and Planning involves analyzing market needs, gathering insights, and defining clear goals to ensure the successful development and implementation of a project or solution.

It involves defining the specific group of users for a product or service and understanding their needs, preferences, and behaviors to tailor the solution effectively.

It focuses on creating intuitive, user-friendly interfaces and seamless experiences that meet the needs of users while ensuring security and compliance in financial transactions.

It involves building the core functionality of the application and ensuring seamless connectivity with existing systems, APIs, and databases for smooth data flow and operational efficiency.

Testing and Assurance of Quality involves thoroughly evaluating the application for performance, security, and usability to ensure it meets the required standards and delivers a flawless user experience.

LendPro Solutions launched a custom lending application with outstanding features, transforming lending operations, which made the process of borrowing very friendly for customers and lenders alike. The borrowers were allowed to apply for loans, submit required documentation, and receive approvals in real-time, thereby reducing the turnaround time in processing loans and making users more satisfied.

The app came with automatic credit scoring, which meant that a borrower would immediately get eligibility information. This was to be linked to the banking systems and payment gateways of LendPro for fast and easy disbursement and repayment tracking. This cut manual work, reduced errors, and improved operational efficiency.

It also offered the app personalized loan suggestions and a clear loan track dashboard to develop trust and improve customer engagement. This made it possible for the company to increase customer retention, speed up loan disbursement, and delight in becoming the leader in digital lending, thanks to the technology-driven transformation.

This allows scoring and grading of advanced algorithm credit directly for rapid and correct decisions on lending.

Upload and secure store all borrower's documents in the security of borrower data and full compliance with applicable financial regulations.

Remind automatically a borrower of payments due and provide an option of real-time tracking of a loan repayment schedule.

Borrowers can track their loans, repayments, and due dates using an intuitive and easy dashboard.

Seamless connectivity with banking APIs-leveraging high-speed transfers in funds, account verifications, and transactions for better reliability and efficiency.

Ensure coverage for different currencies and languages for your app to open access across borders for many audiences.

One-stop reports on loan performance, customer behaviors, and operational efficiencies for making informed decisions based on data.

Offer highly flexible loans like personal loans, business loans, or microloans designed to suit different borrowers and the competent market.

Case Study

Boolean Inc. developed the Private Dog Parks & Locations app, simplifying how dog owners find and book private parks for their pets. With easy location-based searches, booking, and reviews, this app ensures a seamless experience for finding safe, fun spots for dogs to enjoy.

We work with great companies of all shapes and sizes.

.png)

.webp)

.png)

.png)