Introduction

Are You Looking for Fintech Startup Ideas?

The fintech sector is booming—and rightly so. Digital payments, AI banking, and blockchain are revolutionizing finance, and fintech companies are helping to lead the charge to a cashless, tech-enabled future.

But here’s the reality:

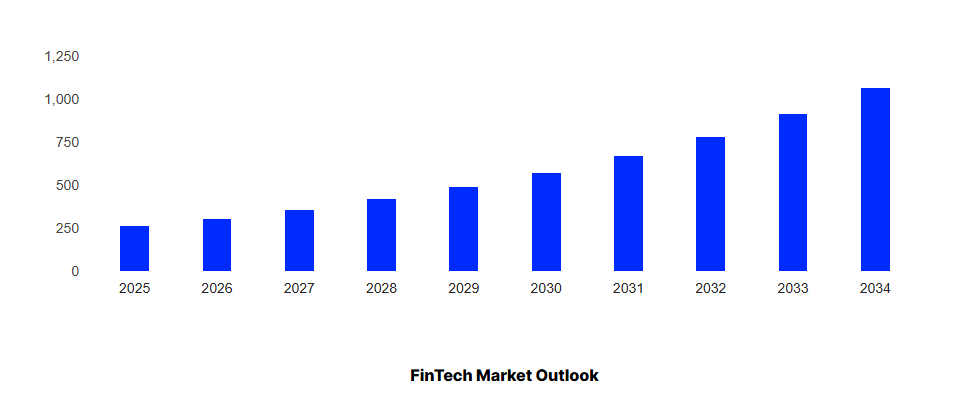

- The sector is huge, with a market value of 226.71 billion in 2024 and predicted to be 1.1 trillion by 2032 (16.2% annual growth)

- Opportunities are plentiful—from budgeting fintech apps to AI-enhanced finance tools.

- Yet most aspiring founders hit one roadblock: They don’t know which fintech app idea to pursue.

If you’re searching for lucrative fintech startup ideas but feel stuck, this guide is your solution.

We’ve analyzed trends, studied top fintech apps 2025 will demand, and compiled 10 cutting-edge fintech business ideas—complete with real-world fintech examples and actionable steps.

Whether you want to build a fintech app or launch a fintech startup company, these concepts will help you:

🔹 Stand out in a competitive market

🔹 Solve real financial pain points

🔹 Tap into booming fintech applications like AI, DeFi, and embedded finance

Let’s explore the best fintech apps of tomorrow—and how you can create one today.

Why the Fintech Industry is a Goldmine for Startups

The global fintech market isn’t just growing—it’s sprinting. Fueled by AI, blockchain, and a hunger for frictionless finance, this sector is reshaping how money moves worldwide.

Here’s what every future-focused founder needs to know:

By the Numbers: Fintech’s Explosive Growth

- Market Size: Valued at $226 billion in 2024, with over 36,000 fintech startups competing for a slice.

- Hotspot: North America leads adoption, but emerging markets are catching up fast.

- Tech-Driven: A staggering 90% of fintech companies rely on AI and machine learning, proving automation isn’t optional anymore.

Where the Opportunity Lies

- Digital Payments Dominate (25% of the fintech market share)

Think: Contactless wallets, cross-border remittance apps (hint: one of our top fintech apps 2025 picks covers this).

- Institutional Trust is Rising

60% of credit unions and 49% of banks now partner with fintechs—a green light for B2B solutions.

- Public Markets Are All-In

463 fintech stocks trade on NASDAQ alone, signaling investor confidence.

What’s Fueling the Boom?

- Regulation Meets Innovation: Governments are balancing open banking policies with tighter security (hello, fintech applications with built-in compliance!).

- Consumer Demand: Users crave apps that merge banking, investing, and budgeting into one seamless experience—aka the future of fintech startups.

If you’re sitting on a fintech app idea, now’s the time to act. The market’s growing at 15%+ annually, and the next unicorn fintech business could be yours.

Top Fintech App Ideas Disrupting the Industry in 2025

Now that we’ve looked at the explosive growth of the fintech space, let’s explore the ideas driving that momentum.

Whether you’re an aspiring entrepreneur, a seasoned business owner, or simply curious about where the industry is headed, these fintech startup ideas will give you clarity and direction.

We’ll walk through proven concepts, emerging trends, and even some bold app ideas for startups that shouldn’t hit the mainstream yet.

If you’ve been wondering how to start a fintech business or are looking for application ideas for startups, this guide will help you identify opportunities that align with your vision.

So, let’s dive into the most promising and disruptive fintech app ideas for 2025, starting with one of the biggest players in the game:

- Digital Banking: The Future of Branchless Finance

Let’s start with the first of the fintech startup ideas.

The digital banking revolution is here, and it’s growing at lightning speed.

In the U.S. alone, the Net Interest Income of digital banks is projected to hit $247.07 billion by 2025, proving that consumers are ditching traditional banks for smarter, faster alternatives.

Why This Fintech App Idea is a Game-Changer

- No physical branches = lower costs (and better rates for users).

- Mobile-first convenience—bank anytime, anywhere.

- Hyper-personalization using AI to analyze spending habits.

Key Features to Include in Your Digital Banking App

- Instant Account Opening – No paperwork, just a selfie and ID scan.

- AI-Powered Financial Insights – Real-time spending analysis & savings tips.

- Fee-Free Transactions – Attract users tired of hidden bank charges.

- Integrated Money Management – Budgeting, investing, and loans in one place.

- Biometric Security – Fingerprint & facial recognition for fraud prevention.

Real-World Fintech Examples Leading the Way

- Chime (U.S.) – Early paycheck access & automatic savings.

- Revolut (Europe) – Multi-currency accounts & crypto trading.

- Nubank (Brazil) – Credit cards with no annual fees.

How to Start a Fintech Business in Digital Banking

- Pick a Niche – Teens, freelancers, or expats?

- Partner with a Licensed Bank – Ensure regulatory compliance.

- Build an MVP – Focus on core features like payments & savings.

- Leverage AI & Open Banking – Offer smarter tools than traditional banks.

Pro Tip: Digital banks thrive on customer experience—make your app 10x smoother than legacy banking apps to win loyal users.

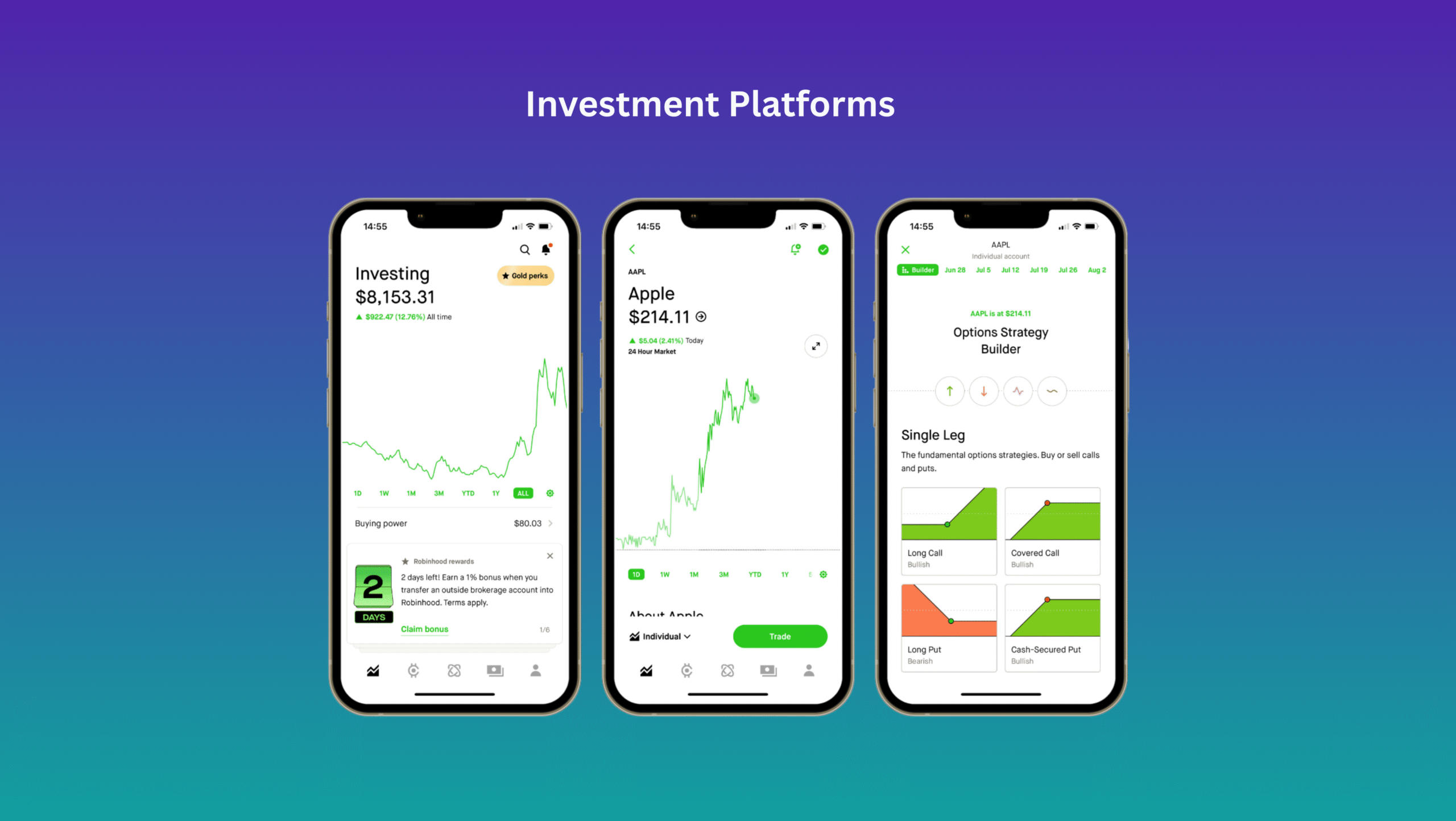

- Investment Platforms

The rise of fintech apps has turned investing from a Wall Street privilege into an everyday activity.

Thanks to digital investment platforms, millions now trade stocks, crypto, and ETFs right from their smartphones, making this one of the top fintech apps 2025 will demand.

Why Investment Platforms Are a Hot Fintech Startup Idea

- Exploding Demand: Over 100M+ retail investors globally, with Gen Z leading the charge.

- Passive Income Craze: People want automated investing (robo-advisors) and alternative assets (crypto, real estate).

- Low-Cost Entry: Fractional shares & micro-investing attract first-timers.

Must-Have Features for Your Fintech Investment App

- Zero-Commission Trading – Attract users tired of broker fees.

- AI-Powered Portfolio Recommendations – Personalized strategies based on risk tolerance.

- Social Investing – Copy trades from top-performing investors.

- Automated Round-Ups – Invest spare change from daily purchases.

- Multi-Asset Support – Stocks, crypto, ETFs, and even tokenized real estate.

- Educational Tools – Bite-sized lessons to boost financial literacy.

Real-World Fintech Examples

- Robinhood – Pioneered commission-free trading (and gamified investing).

- eToro – Social investing & crypto integration.

- Acorns – Micro-investing via round-ups.

How to Start a Fintech Company in This Space

- Choose Your Niche – Focus on crypto-first traders, ESG investors, or retirement savers.

- Partner with a Brokerage – Ensure regulatory compliance (SEC/FCA licenses).

- Prioritize UX – Make complex investing simple and addictive.

- Monetize Smart – Premium analytics, subscription tiers, or order flow payments.

Pro Tip: Add AI tax optimization—a rare feature that automatically minimizes capital gains taxes for users.

- P2P Payment Solutions: Instant Money Transfers

If you’ve ever split a dinner bill, paid rent, or sent money to a friend, you’ve likely used a P2P payment app like Venmo or Zelle.

These platforms have revolutionized how we exchange money, and the market is only getting bigger.

For fintech startups, building a peer-to-peer payment solution isn’t just a smart move—it’s a lucrative fintech business opportunity with massive adoption potential.

Why P2P Payment Apps Are a Must-Consider Fintech Startup Idea

- Explosive Growth: Digital wallets and P2P payments are projected to handle $9 trillion in transactions by 2025.

- Global Demand: From freelancers to gig workers, everyone needs fast, fee-free transfers.

- Tech Advancements: NFC, biometrics, and blockchain make transactions safer and instant.

Key Features to Include in Your P2P Payment App

- Instant Money Transfer – No waiting periods; funds move in seconds.

- QR Code Payments – Scan-to-pay for in-person transactions (great for markets like India & Brazil).

- Request & Split Bills – Perfect for roommates, group trips, or shared subscriptions.

- Payment Reminders – Automated nudges for pending dues (reduces awkward “you owe me” texts).

- Biometric Authentication – Fingerprint or face recognition for fraud-proof security.

- Multi-Currency Support – Essential for cross-border fintech apps.

Real-World Fintech Examples

- Venmo (U.S.) – Social feed + payments = viral growth.

- Paytm (India) – QR-based payments dominating local markets.

- Wise (formerly TransferWise) – Low-cost international transfers.

How to Build a Fintech App Like This

- Solve a Pain Point – Focus on underbanked regions, freelancers, or crypto-friendly transfers.

- Leverage Existing Infrastructure – Partner with banks or use APIs like Plaid for seamless bank linking.

- Gamify Engagement – Reward users for referrals or frequent use (e.g., cashback).

- Prioritize Compliance – Stay ahead of AML (anti-money laundering) and KYC (know your customer) regulations.

Pro Tip: Add a “Pay with Voice” feature—an app idea that doesn’t exist widely yet—for hands-free transactions.

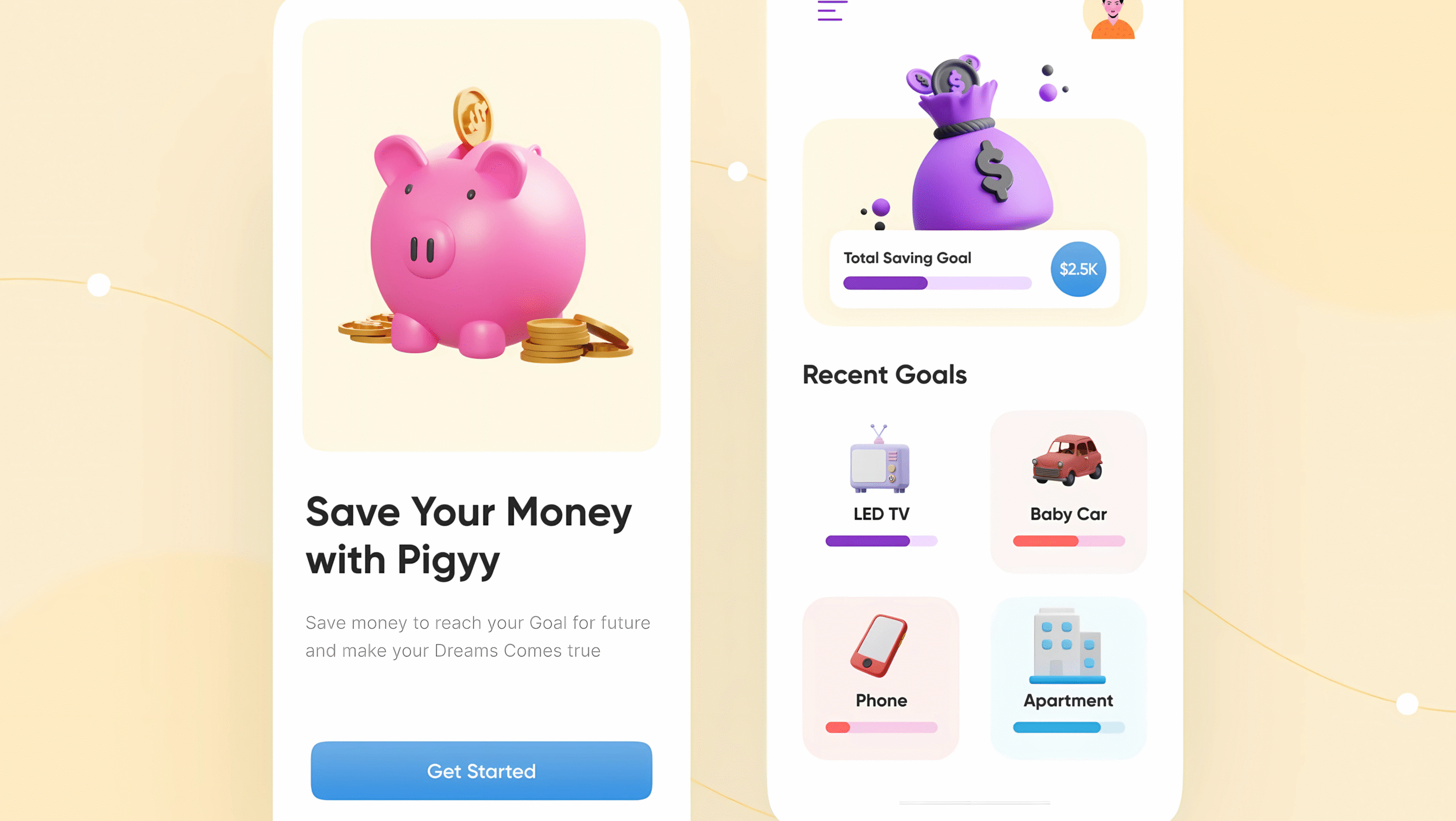

- Money-Saving Platforms

We’ve all been there – that moment when you check your bank account and wonder, “Where did all my money go?”

In our swipe-happy world, saving feels harder than ever. But here’s the good news: financial technology is flipping the script.

The rise of personal finance startups has turned saving from a chore into an effortless, even rewarding habit. These best fintech apps use behavioral psychology and AI to:

- Automatically rescue money before you can spend it

- Turn micro-savings into real wealth over time

- Make financial discipline feel like a game you want to win

Consider this: While traditional banks offer measly 0.01% interest, innovative fintech projects like Digit have helped users save over $8 billion collectively by making the process invisible and intelligent.

The Market Opportunity

- 78% of millennials would switch banks for better savings tools

- The global personal finance app market will hit $1.5 billion by 2027

- Top-rated money apps see 3x higher retention than traditional banking apps

Why This is One of the Best Fintech Business Ideas

- Universal Struggle: 60% of Americans can’t cover a $1,000 emergency (meaning everyone needs help saving).

- Behavioral Tech Wins: Apps that “nudge” users save 3x more than traditional banking.

- Subscription Goldmine: Freemium models (e.g., $3/month for premium features) scale beautifully.

Key Features for Money-Saving Fintech Platforms

- Automated Savings Plans: The app automatically saves money for users based on their income, spending habits, and personalized rules.

- Cashback & Rewards: Users earn cashback or bonuses when they save money or hit financial goals.

- Expense Tracking: Tracks and categorizes spending to show users where they can save more.

- Goal-Based Savings: Helps users set targets (e.g., vacation fund, emergency savings) and tracks progress.

- High-Yield Savings & Investments: Savings grow faster with competitive interest rates or micro-investing options.

Real-World Fintech Examples

- Digit – Analyzes income/spending, silently saves the “perfect amount.”

- Qapital – Rule-based savings (“save $5 every time it rains”).

- Chip (UK) – AI that safely saves what you won’t miss.

How to Start This Fintech Business

- Pick a Niche – Gen Z travelers, freelancers with irregular income, or couples saving for homes.

- Gamify It – Badges for streaks, shareable milestones (social proof = growth).

- Monetize – Premium analytics, partner with banks (referral fees for high-yield savings accounts).

- Go Beyond Savings – Layer in micro-investing or debt payoff plans.

Pro Tip: Add a “Save with Friends” challenge—a fintech idea that barely exists—where groups pool goals (e.g., “10 friends save $1K each for a Vegas trip”).

- Crypto Exchange Platforms

Here we have it—the future of finance, powered by blockchain.

Crypto exchanges aren’t just trading platforms; they’re the foundation of the new digital economy.

And with Bitcoin and altcoins going mainstream, this is one of the hottest fintech opportunities today.

The best part? While adoption is exploding, true innovation in this space is still wide open. Most exchanges still feel clunky, insecure, or overly complex. That’s where you come in.

With the right crypto exchange platform, you could:

- Democratize access to digital assets

- Challenge giants like Binance and Coinbase with a better UX

- Tap into a market where global trading volume exceeds $10 trillion annually

Why This Fintech Goldmine Can’t Be Ignored

- Over 20% of US adults now own cryptocurrency

- Hedge funds, banks, and even governments are going crypto

- Blockchain infrastructure has never been more developer-friendly

Must-Have Features for Your Crypto Exchange App

- Multi-Coin Support – Trade Bitcoin, Ethereum, Solana, and trending altcoins.

- Instant Buy/Sell – Credit card, bank transfer, and P2P payment options.

- Secure Wallet Integration – Non-custodial (user-controlled) or custodial storage.

- Real-Time Market Data – Live price charts, candlestick graphs, and trading volumes.

- Staking & Yield Farming – Earn passive income by locking crypto assets.

- Low Trading Fees – Competitive rates (e.g., 0.1% per trade) to attract users.

- KYC/AML Compliance – Identity verification for security and regulation.

Top Fintech Examples

- Binance – Largest global exchange with 500+ coins.

- Coinbase – Beginner-friendly, regulatory-compliant platform.

- Kraken – Low fees and strong security.

How to Build a Fintech Crypto Exchange

- Choose Your Niche – Focus on beginners, advanced traders, or DeFi enthusiasts.

- Prioritize Security – Use cold storage, 2FA, and encryption.

- Liquidity Partnerships – Integrate APIs from major exchanges for smooth trading.

- Monetization – Charge trading fees, offer premium analytics, or launch a native token.

Pro Tip: Add AI-powered trading bots—a rare feature that helps users automate strategies.

- RegTech Platforms

RegTech solutions are transforming how businesses handle financial compliance.

These financial technology examples use AI to simplify complex regulations, making them essential tools for banks, fintech startups, and SMEs alike.

Key Features & Capabilities

- AI Regulation Scanner

- Continuously monitors 500+ global regulators

- Example: Flags new crypto reporting rules in the EU before they take effect

- Automated Compliance Checklists

- Converts legal jargon into actionable steps

- Example: “To comply with AML Rule 2023-5: 1) Verify client IDs 2) Screen against watchlists”

- Risk Heatmaps

- Visual dashboard showing compliance gaps

- Example: “83% compliant with KYC rules (3 actions needed)”

- Document Auto-Generator

- Creates audit-ready reports with one click

- Example: Produces FINRA quarterly filings in 10 minutes vs. 10 hours

Pro Tip from Industry Experts

“The winning fintech app ideas in this space combine two things: 1) Deep regulatory knowledge, 2) Dead-simple UX. Most platforms fail at #2.”

- Add “Compliance Health Scores” (like credit scores) to help users track progress at a glance

Real-World Fintech Examples

- ComplyAdvantage (AI-powered risk detection)

- Chainalysis (crypto compliance tools)

- Ascent (automated regulation tracking)

Why This is a Top Fintech Startup Idea

✔ $270B+ spent annually on financial compliance

✔ 40% cost savings for firms using RegTech vs manual processes

✔ Recurring revenue model (subscription-based)

Your Move in This Market

- Specialize (pick banking, crypto, or cross-border payments)

- Partner with legal firms for credibility

- Monetize through SaaS pricing or API calls

Ready to build the fintech mobile app that makes compliance painless? The regulatory wave is only getting bigger – now’s your time to ride it.

(Need help identifying the most underserved compliance niche? Let’s analyze the data together.)

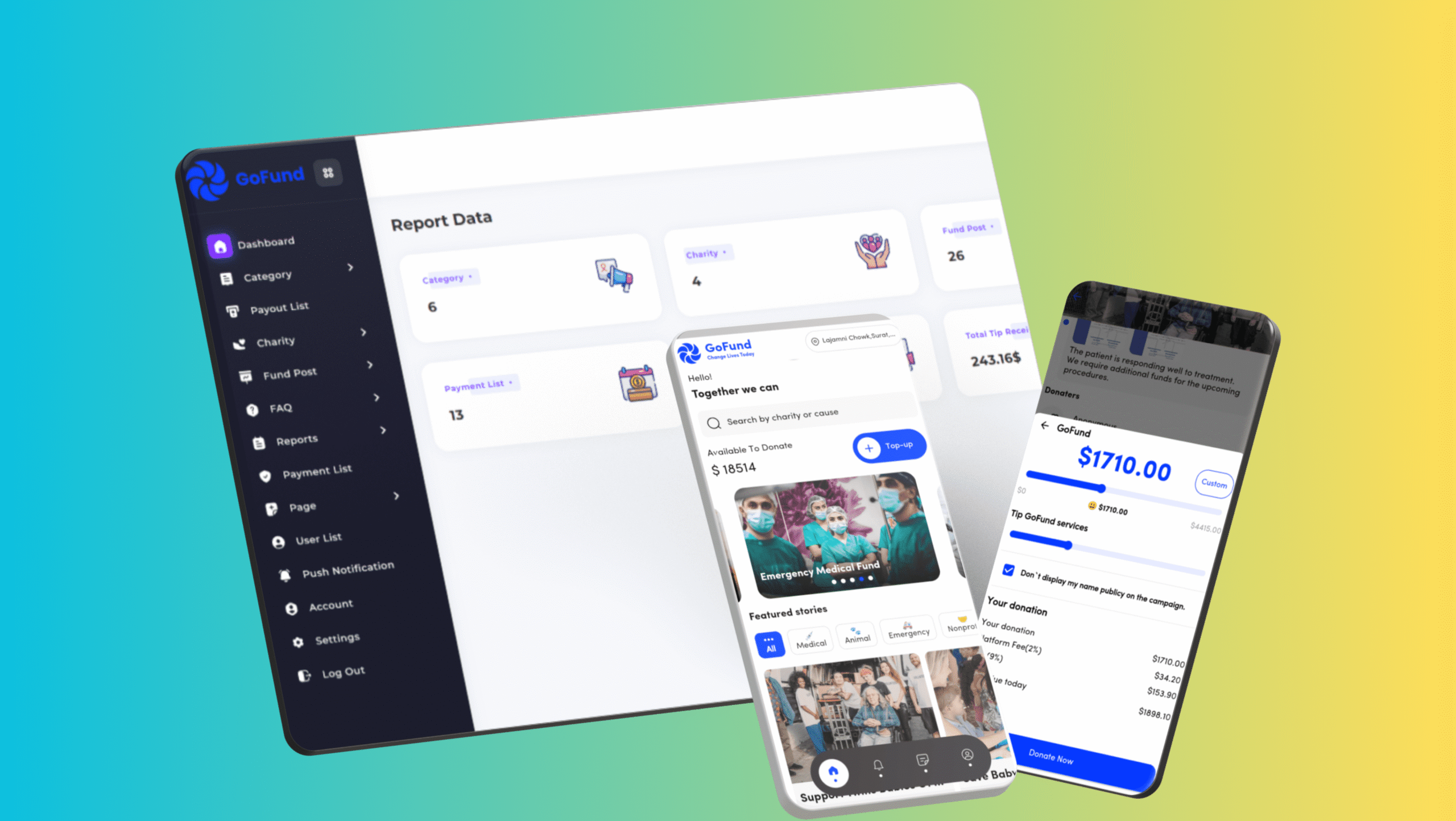

- Crowdfunding Solutions

Crowdfunding – one of the most versatile ways to finance mobile apps and startups today.

Whether you think of it to be a fintech business idea (it is) or otherwise, it is transforming how ideas get funding!

The definition is easy – crowdfunding helps entrepreneurs raise capital directly from private individuals and provide value in return. This could be:

- Equity stakes in promising startups

- Early access to innovative products

- Profit-sharing arrangements

- Pure donations for social causes

With over 30,000 fintech startups currently operational globally, platforms like Kickstarter and GoFundMe have shown how powerful crowdfunding can be.

Making crowdfunding app development an idea is one of the most attractive opportunities in fintech apps today!

Must-Have Features for Crowdfunding Platforms

- Project Funding Campaigns

- Enable creators to showcase their vision and set funding targets with clear timelines.

- Rewards-Based Crowdfunding

- Allow backers to receive tiered rewards (products, experiences) based on contribution levels.

- Equity Crowdfunding

- Facilitate investments in startups in exchange for actual ownership stakes.

- Transparent Funding Allocation

- Provide real-time visibility into how raised funds are being utilized.

- Social Media Integration

- Enable easy campaign sharing across all major platforms to maximize reach.

Real-World Fintech Examples

- Kickstarter – The pioneer in rewards-based crowdfunding

- SeedInvest – Leading equity crowdfunding platform

- GoFundMe – Dominates personal cause fundraising

How to Build a Winning Crowdfunding Platform

- Identify Your Niche: Focus on specific sectors like tech hardware, social causes, or local businesses

- Leverage Existing Payment Infrastructure: Integrate with payment processors like Stripe or Plaid for seamless transactions

- Gamify the Experience: Implement referral bonuses and achievement badges to boost engagement

- Prioritize Regulatory Compliance: Ensure your platform meets all SEC/FCA regulations for equity crowdfunding

- Add Unique Value: Consider innovative features like:

- AI-powered funding goal recommendations

- Blockchain-based transparency tools

- VR project showcases

Pro Tip: The most successful fintech mobile apps in this space combine easy funding with community building – turn backers into brand ambassadors.

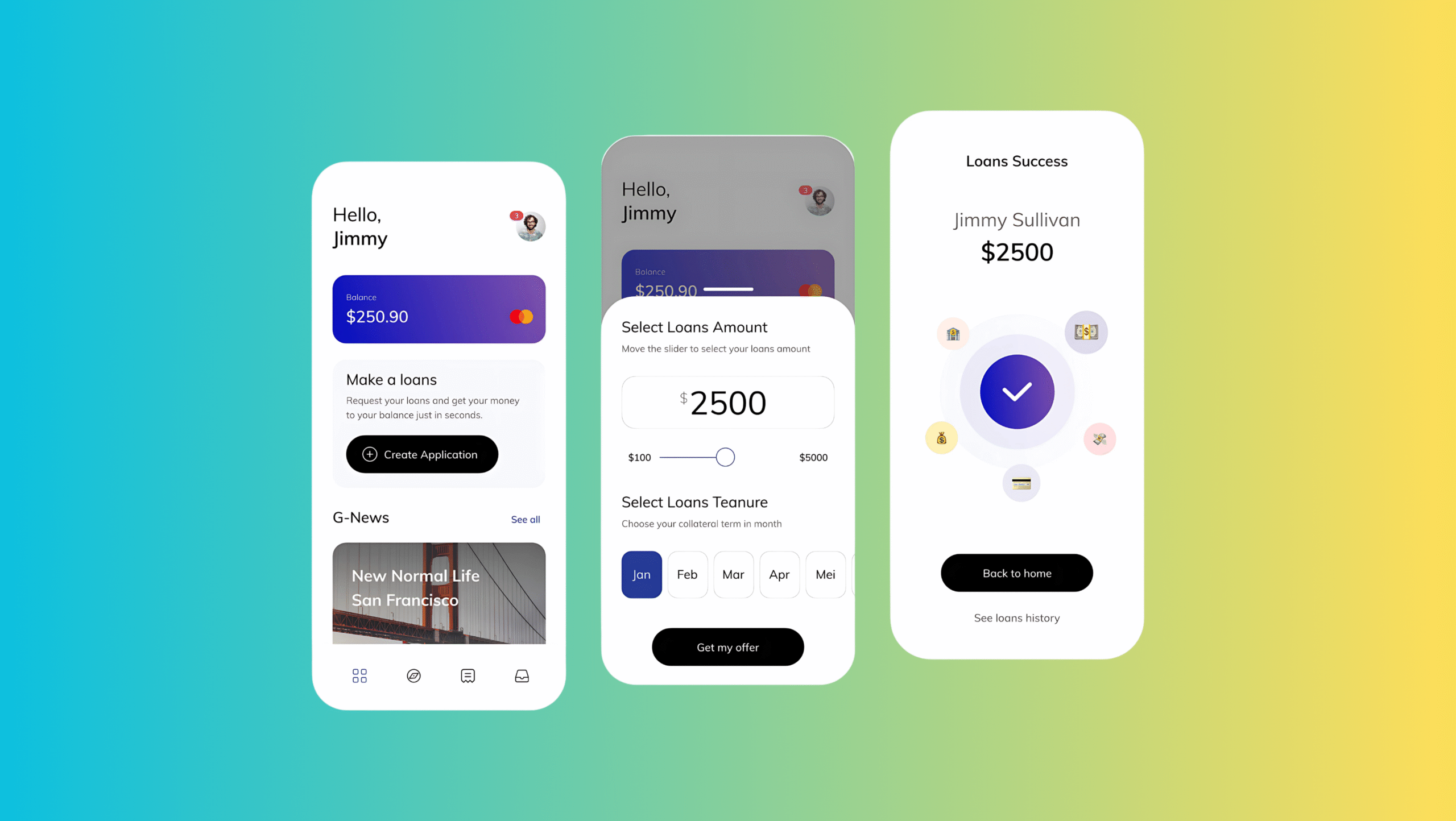

- Loan-Lending Platforms

One of the most impactful fintech startup ideas today is creating modern loan-lending platforms.

These fintech applications are transforming how people and businesses access credit – faster, smarter, and more inclusively than traditional banks.

As financial technology evolves, lending platforms now offer:

- Instant approvals using AI-driven credit scoring

- Personalized rates based on real financial behavior

- Flexible repayment options tailored to cash flows

- Peer-to-peer models that cut out institutional middlemen

With global digital lending projected to reach $8.5 trillion by 2025, this represents one of the most promising app ideas for startups in finance.

Essential Features for Lending Platforms

- AI Credit Scoring

- Analyze alternative data (cash flow, education, shopping habits) beyond traditional FICO scores

- Automated Underwriting

- Instant loan decisions using machine learning algorithms

- Customizable Loan Products

- Offer options like:

- Paycheck advances

- Education loans

- Small business microloans

- Blockchain-Based Contracts

- Smart contracts that auto-execute loan terms and payments

- Financial Health Tools

- Help borrowers improve their credit scores and money management.

Real-World Fintech Examples

- SoFi (Student loan refinancing leader)

- LendingClub (Pioneer in peer-to-peer lending)

- Kabbage (Small business loan automation)

How to Start a Fintech Business in Lending

- Identify Your Niche

- Build Your Tech Stack

- Ensure Regulatory Compliance

- Monetization Strategies

Pro Tip: The most successful personal finance startups in lending combine access to capital with financial education, helping borrowers build credit while accessing funds.

With traditional banks still slow to adapt, innovative lending platforms represent one of the best app ideas collection opportunities in fintech today. The key is finding the right borrower segment and creating a seamless digital experience.

(Need help identifying the most profitable lending niche or navigating regulations? Let’s explore your options.)

- POS Payment Platforms

One of the most transformative fintech startup ideas today is developing modern POS (Point-of-Sale) payment platforms.

These fintech applications are revolutionizing how businesses accept payments – faster, smarter, and more securely than traditional systems.

As cashless payments dominate commerce, next-gen POS platforms now offer:

- Omnichannel payments (in-store, online, mobile)

- Instant settlement with real-time reporting

- Integrated business tools (inventory, CRM, analytics)

- Contactless options (NFC, QR codes, mobile wallets)

With global digital payment volume projected to hit $15 trillion by 2027, this represents one of the most lucrative app ideas for startups in financial technology.

Must-Have Features for POS Platforms

- Unified Payment Processing

- Accept all major payment types:

- Credit/debit cards

- Digital wallets (Apple/Google Pay)

- Buy-Now-Pay-Later options

- Cryptocurrency payments

- Smart Business Dashboard

- Real-time analytics on:

- Sales trends

- Inventory levels

- Customer purchase patterns

- Mobile POS Capabilities

- Turn smartphones/tablets into payment terminals

- Automated Reconciliation

- Sync payments with accounting software (QuickBooks, Xero)

- Loyalty Program Integration

- Built-in rewards and membership management

Real-World Fintech Examples

- Square (Pioneer in mobile POS systems)

- Toast (Restaurant-focused POS leader)

- Shopify POS (E-commerce payment integration)

How to Start a Fintech Business in POS Payments

- Identify Your Niche

- Focus on specific industries like:

- Retail stores

- Food trucks

- Service businesses (salons, contractors)

- Build Your Tech Stack

- Payment processor integrations

- Hardware/software compatibility

- Security protocols (PCI DSS compliance)

- Monetization Strategies

- Transaction fees (2-3% per swipe)

- Monthly SaaS subscriptions

- Premium features (advanced analytics)

- Differentiate Your Solution

- Consider adding:

- AI-powered sales recommendations

- AR product visualization

- Voice-activated payments

Pro Tip: The most successful personal finance startups in this space combine payments with value-added services, helping merchants grow while processing transactions.

With cash transactions declining globally, innovative POS platforms represent one of the best app idea collection opportunities in fintech. The key is creating a system that’s both powerful and easy for small businesses to adopt.

- Insurtech Solutions

One of the most untapped fintech business ideas today is developing innovative insurtech platforms.

These cutting-edge examples of financial technology are using AI to transform how insurance works, making it faster, fairer, and more accessible.

While most fintech mobile apps focus on banking or payments, insurtech represents one of the most promising app ideas that don’t exist at scale yet. Modern solutions now offer:

- Usage-based insurance (pay-as-you-drive, pay-as-you-live)

- Instant claims processing via computer vision

- Hyper-personalized pricing using IoT data

- Automated risk assessment through machine learning

With the global insurtech market projected to reach $158 billion by 2030, this sector offers huge potential for AI fintech startups.

Must-Have Features for Insurtech Solutions

- AI-Powered Instant Quotes – Get personalized insurance quotes in under 60 seconds

- Automated Claims Processing – Submit photos/videos for instant damage assessment

- Behavior-Based Pricing – Premiums adjust in real-time based on user actions

- IoT Device Integration – Sync with wearables/smart home devices for risk monitoring

- Micro-Insurance Options – Buy hourly/daily coverage for specific needs

- Blockchain Smart Contracts – Auto-executing policies with instant payouts

- Preventative Health Tools – Earn rewards for maintaining healthy habits

- Peer-to-Peer Insurance – Community risk pools with shared savings

- AR Property Inspections – Virtual home/car evaluations using smartphone cameras

- Voice-Activated Assistants – Manage policies and claims via voice commands

Real-World Fintech Examples

- Lemonade (AI-powered home/renters insurance)

- Root Insurance (Usage-based auto insurance)

- Oscar Health (Tech-driven health insurance)

How to Build a Winning Insurtech Business

- Focus on Pain Points

- Eliminate long forms and waiting periods

- Fight industry distrust with transparency

- Leverage Emerging Tech

- Partner with IoT device makers

- Integrate with health/fitness apps

- Navigate Regulations

- Obtain proper insurance licenses

- Ensure data privacy compliance

- Monetization Models

- Premium subscriptions

- Commission on policies

- Data insights for partners

Pro Tip: The best fintech apps in this space combine insurance with prevention, helping customers avoid claims rather than just process them.

With 60% of consumers willing to switch to tech-first insurers, insurtech represents one of the most exciting fintech business ideas today.

The winners will be those who make insurance simple, smart, and surprisingly delightful.

How Boolean Inc. Can Help You Build Your FinTech App?

Building a fintech app? We get it—it’s exciting, but also a bit overwhelming. Between complex regulations, cutting-edge tech, and sky-high user expectations, where do you even start?

That’s where Boolean Inc. comes in. Think of us as your fintech co-pilots. We’ve helped dozens of founders like you navigate this journey successfully, and we’d love to help you too.

Why Partner with Boolean Inc.?

- Proven Fintech Expertise – We’ve helped launch 50+ fintech apps across lending, payments, and wealth management.

- AI & Blockchain Ready – Our proprietary algorithms optimize risk assessment, fraud detection, and smart contract automation.

- Regulatory Compliance Built-In – Stay ahead of AML, KYC, and data privacy laws with our pre-configured compliance modules.

- Scalable Infrastructure – Our cloud-based architecture supports 1M+ transactions per second with 99.99% uptime.

Our FinTech Development Services

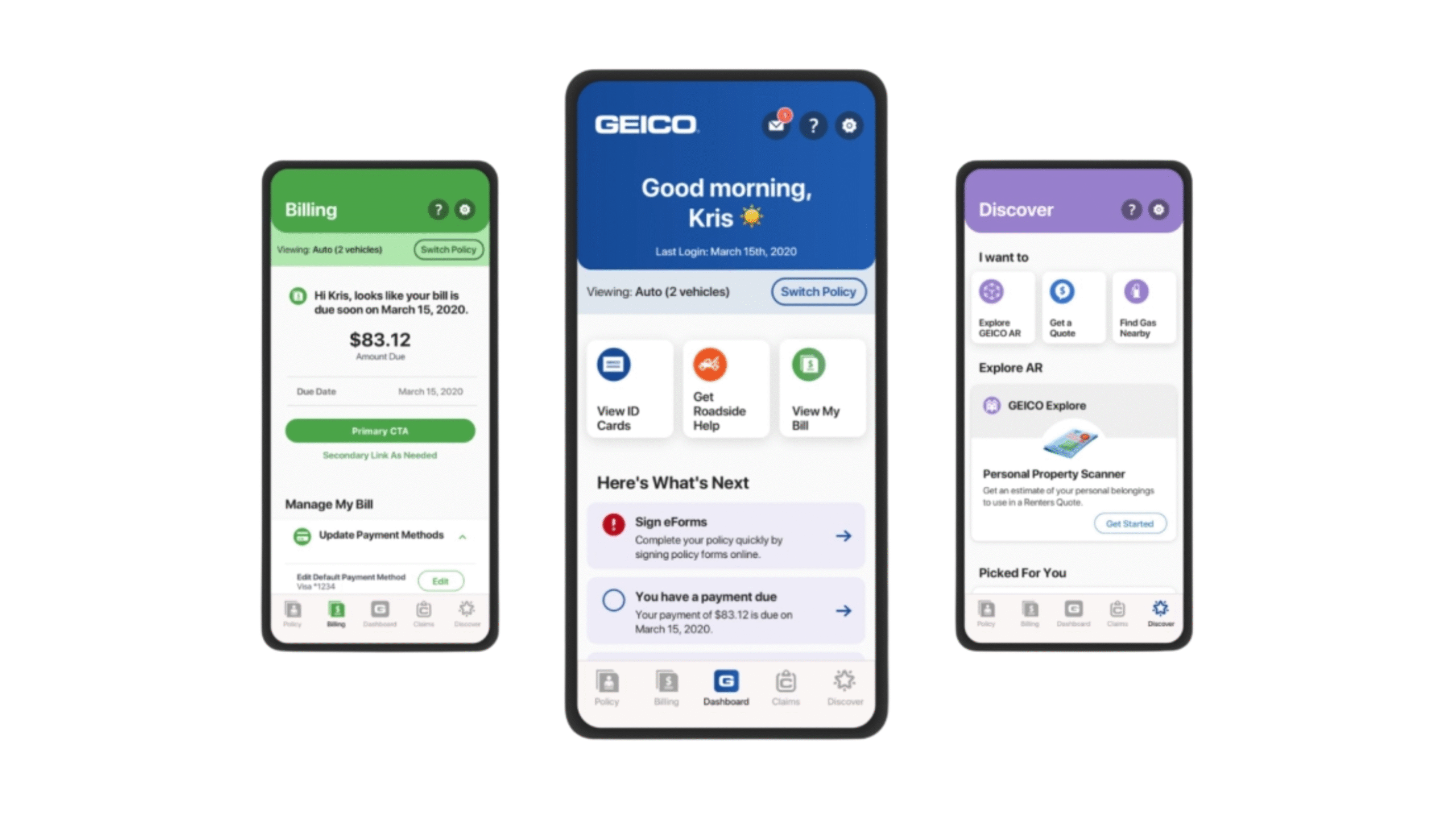

- Custom FinTech App Development – From digital banking apps to DeFi platforms, we build secure, user-friendly solutions.

- AI-Powered Financial Tools – Credit scoring, robo-advisors, and fraud detection are powered by machine learning.

- API & Third-Party Integrations – Seamlessly connect with banks, payment gateways, and crypto exchanges.

- White-Label Solutions – Launch your branded fintech product in under 90 days using our ready-made frameworks.

Get Started Today

- Book a Free Consultation – Discuss your fintech vision with our experts.

- Get a Custom Roadmap – We’ll outline tech stack, costs, and timeline.

- Build & Launch – From MVP to full-scale deployment, we handle it all.

“Boolean Inc. doesn’t just build fintech apps—we build the future of finance.”

📞 Contact us now to schedule your free fintech strategy session.

Conclusion

As we’ve witnessed, the fintech landscape in 2025 is bustling with opportunity.

From digital banking products to AI-enabled fintech applications, these are more than just ideas—they are the future of how users & businesses will manage their money.

If you’re truly planning on launching a fintech startup, now is your time. The demand for smarter, faster, and more inclusive financial products has only been increasing every day.

And with so many examples of fintech success already out there, you’re not starting from scratch—you’re building on proven ground while still having room to innovate.

Whether your focus is on personal finance startups, fintech AI startups, or even app ideas that don’t exist yet, the key is to start small, validate your concept, and build around real-world user needs.

Keep in mind:

- Research the types of fintech most aligned with your goals

- Study top fintech apps 2025 to understand what’s working

- Learn how to start a fintech company legally and sustainably

- Look into partnerships with companies that buy app ideas or support early-stage ventures

Great fintech applications don’t just manage money—they solve problems, simplify lives, and create financial confidence.

So, whether you’re an innovator seeking business ideas for apps or an entrepreneur ready to bring your vision to life, we hope this guide has sparked your imagination.

Now go out there and build the next great fintech startup.

The industry is waiting for your idea.

FAQs

- Are there any app ideas that don’t exist yet in fintech?

Yes! Opportunities still exist in hyper-niche finance tools, such as apps for gig workers, green finance, youth savings, and AI-powered debt management. Innovation is still very much alive in fintech.

- What are some of the best fintech startup ideas in the year 2025?

Some of the best fintech startup ideas in 2025 are digital banking, AI-powered personal finance apps, cryptocurrency investment platforms, peer-to-peer lending apps, and insurance tech (insurtech) ideas.

- How do I start a fintech company?

To start a fintech company, you want to start with a validated app idea, understand what regulations you have to follow in your geographical area, build a secure MVP, and partner with financial institutions or technology providers where needed.

- What are some examples of fintech apps that exist in the real world?

Some examples of fintech are apps like Revolut, Chime, Robinhood, Mint, and Stripe etc. These are only a few examples of how some companies have digitized traditional financial services with a user- first perspective.

- Can I sell my fintech app idea to a company?

Yes, some companies buy app ideas, typically they will only consider them if you have validated your idea you have a small or working prototype. Alternatively, you can try to pitch your app idea or prototype to investors or an incubator, or you can enroll in a startup accelerator to see if you can potentially start your fintech venture.