Introduction

In today’s fast-paced digital economy, it is easy and accessible to manage your finances through innovative apps such as Dave, designed to offer cash advances and keep you on top of your budget.

However, what if Dave does not serve the very purpose? Or even, the personal preference for something else, such as a lower subscription fee, a compatible interface with your bank account, etc?

The variety of hundreds will make it difficult to know which one to go for in the end.

This is the guide that helps. We compiled a detailed list to give you the top 20 apps like Dave that stand out for their features, usability, and financial benefits.

From paycheck advance apps to comprehensive money management tools, these will be complex financial needs alternatives for everyone.

Wondering which app provides the best cash advances?

Searching for earning-like apps or apps that empower use with a platform like Chime or Varo?

Whatever you need it for for-budgeting, instant cash, or planning best choices for 2025 are contained herein.

What to Look for in Apps Like Dave

When comparing apps like Dave, consider:

- Cash Advance Limits: Is the allowed amount within the app good enough for your needs?

- Charges and Subscriptions: What are all the mystery charges?

- Bank Compatibility: Does the app work with your bank; for example, Chime or Varo?

- Additional Features: Budgeting tools or financial advisory? Does it offer any?

Here are the top 20 alternatives to Dave.

- EarnIn

Of all the apps that are alternatives to Dave, perhaps the best alternative is EarIin because it provides cash advances at no cost based on your earned income. Users can tip what they feel to be which makes it very flexible and user-friendly.

Pros

- Zero compulsory fees

- Maximum cash advance limit of $500 per pay period

- Fast and seamless integration with your bank account

Cons:

- Requires consistent income to qualify

- Tips can build up to big amounts over time

Why Choose Earnin?

It is the best cash advance app without subscription fees or interest charges. Earnin is a great alternative to apps like Earnin that accept Chime or cash advance apps like Dave when looking for immediate funds without a headache.

- Brigit

Brigit has offered a lot more than mere cash advances like Dave, but it also gives financial insights and tools to manage the budget and avoid overdrafts.

Pros:

- Offers up to $250 in cash advances.

- Credit monitoring and budgeting tools integrated.

- Personal financial insights to help develop better habits.

Cons:

- Costs $9.99 a month to subscribe.

- May not be the best match for users with sporadic income.

Why Choose Brigit?

If you are searching for a full-blown financial wellness app other than being employed for paycheck advances alone, then go for Brigit. With such features, it can also be good for people searching for apps like Brigit and Dave but strong in financial tools.

- Albert

Albert is a cash advance app with the functionality of Dave but also features personalized financial advice from experts.

Pros:

- Cash advance up to $250

- Smart financial guidance with “Albert Genius”

- Savings and budgeting tools for better financial planning

Cons:

- Advanced features need a subscription

- Fewer investment options than specialized platforms

Why Choose Albert?

Albert is a great app for users who need short-term cash and long-term financial planning, all at one go. For anyone asking, “Can I send money with Dave or his alternatives?” more than likely this answer involves the Albert app, for it seems to boast so many useful features.

- Cleo

This is another application that provides budgeting suggestions with a toy-like interaction for cash advances as the Dave app.

Pros:

- It is free for budgeting only.

- A really fun and playful way through which one can make money fun and easy in a chatbot interface.

- Offers up to $100 in cash advances

Cons

- Subscription required for premium features

- The amount of cash advance is not close to other similar apps.

Why Choose Cleo?

If you wanted a playful method of keeping track of finances but still would have access to money apps like Dave, Cleo is a very nice option.

- Empower

Empower lives by its name because it gave its users tools for cash advances and managing finances.

Pros:

- Maximum cash advances of $250

- No credit checks or interest charges

- Includes budgeting functions and delivers savings features

Cons:

- Charges $8 a month in subscription

- Offer limited investment options as compared to other apps

Why Choose Empower?

Empower is a solid choice for users looking for an app that balances payday advance apps like Dave and a functional financial planning tool Empower is a perfect app for users looking for apps like Empower and Dave.

- Klover

The Klover app lets users instantly take advances against income without checking their credit history. The purchase is based on the income of the user.

Pros:

- No fees or interest charges

- Quick access to paycheck advances

- No credit check

Cons:

- The cash advance limit may be lower than other apps

- Needs to link a checking account

Why Choose Klover?

If you are looking for a straightforward, fee-free paycheck advance app like Dave’s, the Klover app is for you. If you want fast access to your paycheck with no hidden fees latched onto it, you found the right place. It’s also great for someone searching for apps like Earnin or apps like Klover looking to get cash quickly and without charging interest.

- FloatMe

FloatMe provides quick and hassle-free access to your earned income with a modest cash advance without any fees.

Pros:

- Cash advances of up to $200 without interest charges

- No credit check required

- Instant transfer options

Cons:

- The cash advance appears to be very low compared to other cash advance apps

- Requires a monthly subscription for access

Why choose FloatMe?

If you’re looking for a simple cash advance app like Dave’s, with a much lower cash advance limit, FloatMe is just the app you need. It works perfectly for those wanting a payday app that is like Dave or similar to one of those apps that provide them with some immediate cash “no fees, simple.”

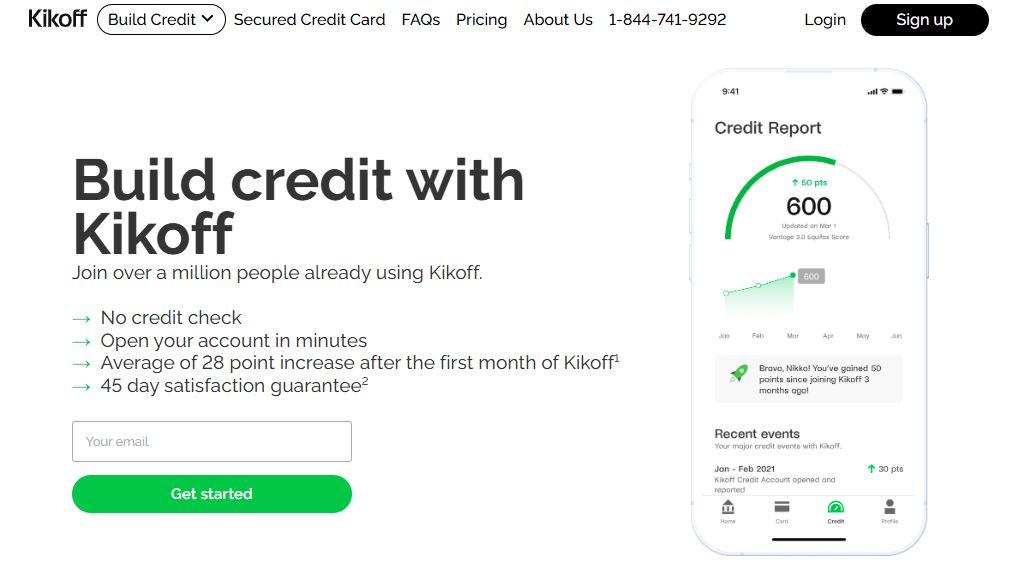

- Kikoff

Kikoff isn’t just any standard payday advance app like Dave. It also helps build a credit score by reporting your transactions to bureaus.

Pros:

- No interest or fees for advances

- Has credit-building features.

- Gives small cash advances:

Cons:

- Lower cash advance amounts

- Works best for those with a regular income.

Why Choose Kikoff?

If you want an app like Dave or Earnin and would like an added advantage to it, Kikoff is your perfect answer. It’s a great alternative for people looking for credit-building apps like Dave while spending on small loans.

- Chime

Chime Online Banking may be one of the nearest unique features it offers, called “SpotMe.” Similar to Dave, SpotMe allows users early access to cash as determined by their direct deposits.

Pros:

- No fees, penalizing fees

- Most integrated and easy money

- All Chime account holders for access

Cons:

- Varied cash advance levels

- Restricted to using a Chime account Only

Why Choose Chime?

Chime is a fantastic facility for anyone in need of apps like Dave that work with Chime. In case someone is already using Chime for his or her banking, it is very easy to source instant cash apps like Dave without having to deal with ridiculous charges and interests.

It is one of the best options while searching for apps similar to Dave that can be used quite comfortably without affecting your current banking setup.

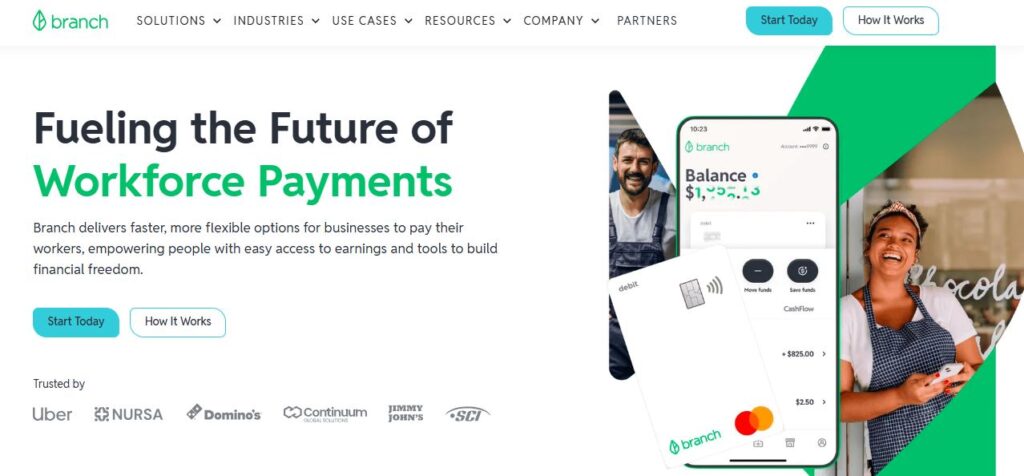

- Branch

Apply cash advance in seconds through the application Branch. This application allows quick access to cash for the amounts earned through financial circuits that are fast and much more personalized regarding your needs and preferences.

Pros:

- Cash advances of up to $500

- No interest, no credit check.

- Financial tools for budgeting and saving.

Cons:

- Must be linked directly with your direct deposit account

- Fees for expedited transfer use

Why Choose Branch?

Branch is the app in case you miss Dave and Earnin, who just grant you an advance without interest. This is by far the best choice for those apps like Brigit or even loan apps like Dave as it brings very quick cash access and financial management.

- MoneyLion

This is another loan app like Dave, Moneylion is one of the cash advance apps that offer investment options and credit-building tools.

Pros:

- Potential cash advances of $250

- No hidden fees and interest on advances

- Offers credit-building loans, investment tools

Cons:

- Need membership for access to all features

- New app users receive a lower cash advance

Why Choose MoneyLion?

If you’re just looking for a cash advance app like Dave, but you want to do some of the things MoneyLion does for building up your credit or growing savings, then it is amazing for supercharged Earnin or Dave app users.

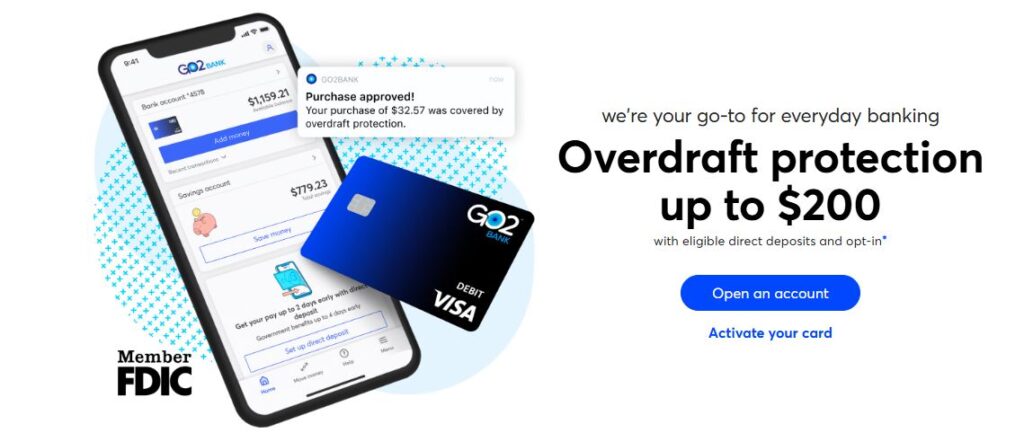

- Go2Bank

Go2Bank offers instant cash advance apps like Dave, focusing on helping users avoid overdraft fees.

Pros:

- Sometimes you get up to $200 cash.

- No credit checks are required.

- Direct deposit is free of charge.

Cons:

- You must have a Go2Bank account.

- Limited types of transactions.

Why choose Go2Bank?

Go2Bank is a fairly decent very uncomplicated way to get applications that are similar to Dave or Earnin for preventing overdrafts and quick access to cash advances found in the cash app similar to Dave-which can save cash flow during emergencies without having credit checking requirements.

- PayActiv

PayActiv permits early wage access to employees before payday using cash advance apps such as Dave, for financial wellness support.

Pros:

- Access earned wages up to 50%

- No credit checks or interest

- Works through the employer to integrate systems

Cons:

- Offered only through participating employers

- Limited other financial services beyond wages

Why choose PayActiv?

PayActiv is that which is able to provide app-like Earnin or app-like payday loans such as Dave, which provide early access to wages. If PayActiv is launched by an employer, there is no need to pay any fees or interest charges to the applications like Dave; one only uses it as a direct way to advance cash immediately.

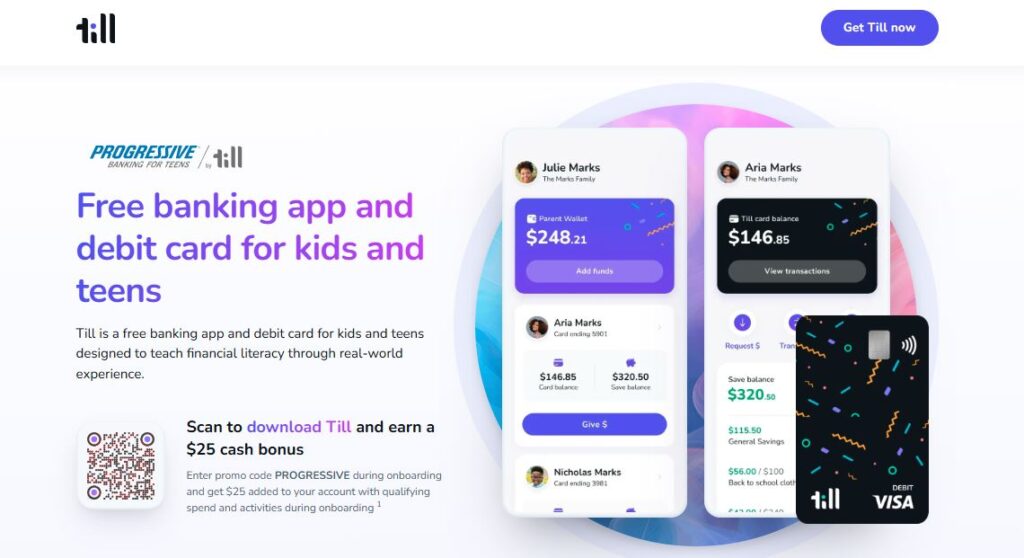

- Till

Till is another excellent alternative for apps like Dave that provides its users with access to earned wages and avoids payday loans.

Pros:

- Up to $200 per paycheck

- No fees, interest, or credit checks

- Easy-to-use mobile app

Cons:

- Disburse cash advances to a certain extent

- Only applicable through participating employers

Why choose Till?

For users seeking apps like Dave and cash advance apps that work with Chime. This is perfect for people who want less complicated payday advance apps like Dave which go directly with your income.

- Varo Bank

Varo Bank comes up with a unique combo for personal banking. It provides instant cash advance apps such as Dave and payday loan apps similar to Dave under very low rates compared to mainstream banking.

Pros:

- Cash advances like Dave’s with no fees or interest

- There are no minimum balances

- Early direct deposit access

Cons:

- Only for those who have set up direct deposit.

- Feature offerings are partially limited only to the Varo Bank account

Why Choose Varo Bank?

It is a great alternative for those looking for apps like Dave, which would have cash advances like Dave without having to pay exorbitantly high fees. It is, therefore, a cheaper version of loan apps such as David for those seeking cash advances without interest.

For users searching for apps similar to Dave that also match Chime, Varo Finance provides an excellent alternative for those who want to access their earned wages early at no subscription fees.

- One@Work

One@Work is another leading financial wellness platform similar to Earnin. However, the main difference is that this app is designed not to allow workers to fall into the trap of payday loans.

It provides flexible cash advance services like Dave and works on an easy-to-use platform, very similar to apps like Empower.

Pros:

- Instant access to earned wages

- There is no credit check and interest charge

- Simple interface

- No hidden fees, making it one of the apps like Dave with no subscription options

Cons:

- Only accessible through employer partnerships

- Available to employees of participating companies only

Why choose One@Work?

Well if you’re looking for something like Earnin and want apps like Dave with easy setup, and no extra fees, then One@Work would be good. It’s an equivalent of payday advance apps, like Dave, but for employees who do not want to worry about subscription charges. That means if your employer offers One@Work, you really can enjoy getting advanced apps like Dave, but at no cost to you, unlike the other loans apps like Dave typically do.

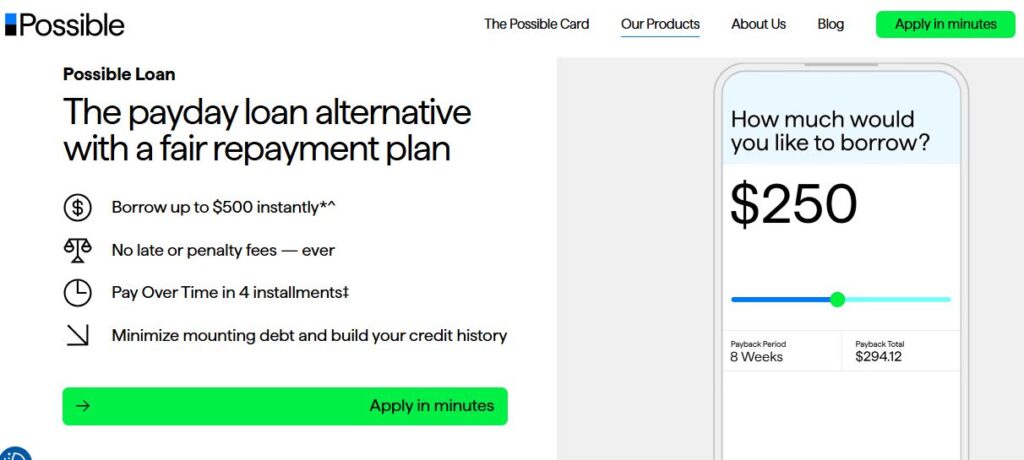

- Possible

Possible is a financial application that offers minuscule advances in cash without debt interest or any sort of hidden fees. It grants hassle-free access to cash without asking for credit checks.

Pros

- No interest or fees

- Cash advance of up to $500

- Easy for use

Cons:

- Limited to users with regular income

- Limited availability per state

Why Choose Possible?

Possible is an interesting option in the case of apps like Dave for the user who seriously needs urgent cash without shelling out much for the fees.

It fits the consumer looking to pay something upfront to use an advance payday application without charging an annual fee.

- DailyPay

DailyPay provides users with the option to access what they have earned at work before payday. A viable option for employees wanting fast access to their earned money without the hassle of payday loan interest rates or fees.

Pros:

- Immediate access to earned wages

- No credit check or interest payment;

- Flexible and convenient access.

Cons:

- Only accessible through partnering firms

- Subscription fees for certain features

Why choose DailyPay?

DailyPay is ideal for cash advance applications and works much like Dave or paycheck advance applications. It is for employees who want to stay clear of payday loans as well as easily access their earnings.

- FlexWage

FlexWage enables workers to access the remuneration they have earned prior to payday, so it is basically a very convenient cash advance app such as Dave. There are no hidden fees and no interest; it is flexible to cater for expenses occurring between paychecks.

Pros:

- Early access to earned wages

- No interest or credit checks

- User simple and easy interface

Cons:

- Only participating employers can avail of it

- Some features might incur costs

Why Choose FlexWage?

Well, if you’re looking for an easy instant cash advance app such as Dave, FlexWage offers you straightforward and fee-free cash advances for employees who do not want payday loans and need to access their funds soon.

- Upstart

The newest app that offers personal loans to benefit one’s finances through AI-directed technology is Upstart; it is one of great choices to consider for a lot of good applications for people like Dave.

Pros:

- Quick Debt Approval: Quick, hassle-free personal loan approvals based on your credit history and income.

- Lower Rates of Interest: Most often, a lower interest rate is offered compared to that of conventional lenders, especially to good credit borrowers.

- Credit Score Construction: Helps improve users’ credit scores, offering manageable repayment terms.

Cons:

- Not all states are included: Not all states have available loan services from Upstart, thus affecting some applicants.

- Larger loan amounts require better credit: Applicants with low scores may not be approved for large loan amounts.

Why Choose Upstart?

Upstart is very much a contender when the app specifically aims at providing required loans at prices affording above-average terms for credit building and use as a substitute to Dave Long with being efficient as well as personalized in applying for loans through an AI-powered platform.

How to Find the Right Apps Like Dave

To get apps like Dave, the following factors must be considered:

- Cash Advance Limits – The app should have the cash advance limits that you will need.

- Fees and Subscriptions – Consider very transparent apps with low fees just like that of Dave.

- Compatible Banks – The app should be compatible with institutions like Chime or Varo.

- Extra Features – Some applications include budget or finance-related tools, which may be among your interests.

- User Reviews – Check reviews for a viable and effective app. These points help you get an instant cash advance app like Dave that best serves your preference.

Which One is Better: Cash Advance Apps Similar to Dave or Payday Loans?

When deciding between cash advance apps similar to Dave and payday loans, it is important to decide between the two. Dave and other such cash advance apps offer you small, short-term income-based loans at little or no interest charges and a minuscule fee. With flexible repayment options, they can be linked to your bank to give you fast and cheap emergency relief.

Payday loans become more appallingly expensive in terms of interest and fees, and it could lead to a debt cycle. They have a much stricter repayment schedule and eligibility. Above all, payday loans may give you a quick cash injection, but cash advance apps are much easier to use and less expensive, making them ideal for most short-term cash users.

Conclusion

As of 2025, various and numerous applications like Dave were scattered in the world to suit some specific money needs. You can as well be looking for applications like Earnin whose system is based on tips. Or, you may want some applications similar to Brigit and Dave that focus on credit building. Or maybe cash apps like Dave, with the possibility of accessing funds right away. It depends.

You can find out the best app for budgeting, fast cash, and finances by looking into these top cash advance apps. Have you ever tried any of these apps? Share your experience and let others know which app has worked best for you.

FAQs

Are cash advance apps like Dave safe?

Absolutely yes, cash advance apps such as Dave are safe to utilize. They employ encoding technology to safeguard private data; however, ensure to check the terms and the fees before using any such app.

What other cash advance apps are there aside from Dave?

Of course, there are other apps like Dave including Brigit, Earnin, and Chime, among others which offer cash advances to help manage other kinds of financial services.

Which cash advance apps allow you to get instant $100 into your account?

Some apps like Earnin or Brigit will allow one to instantly draw up to $100, depending on when the user gets paid or is considered eligible.

What’s the fastest way to get a $200 loan?

You can use apps such as Dave, Earnin, or Brigit, which will allow you to get up to $200 worth of cash instantaneously via advance loans, by asking for them based on what money you have earned so far.

What are advanced cash apps and how do they work?

Cash advance applications allow you to easily access money that’s yet to be paid to you, just like any other loan. You can access small amounts in real-time, and come pay it back as you earn.